Discover Top Online Loans for Quick Cash Solutions With Reliable Loan Providers

In today's busy globe, the requirement for quick cash money remedies has actually come to be significantly common. With the rise of online loan solutions, people have a variety of choices at their fingertips. Whether you are facing an unexpected expense or simply looking for monetary versatility, exploring the world of leading on-line financings can give a sensible option. Nevertheless, the crucial depend on identifying dependable car loan services that offer not only convenience but additionally openness and competitive rates. By unwinding the ins and outs of on-line loans and recognizing the critical variables to take into consideration when selecting a service provider, you can pave the means to protecting the economic help you need.

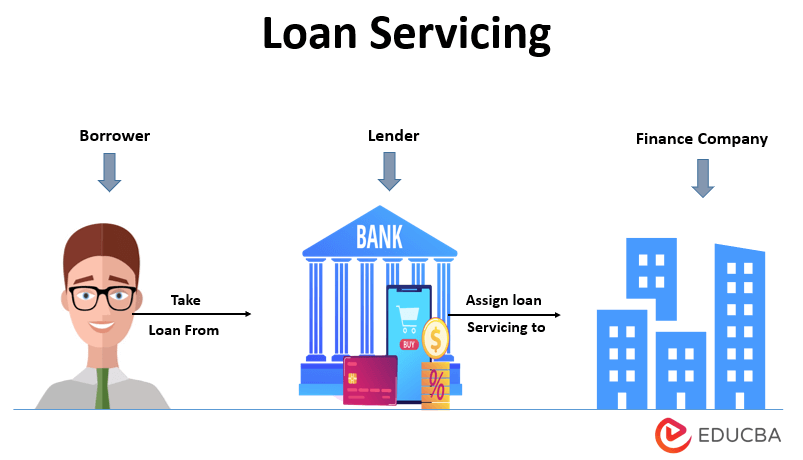

Kinds Of Online Loans

Numerous kinds of on the internet loans accommodate diverse financial needs and conditions, using borrowers a series of options to safeguard fast cash money remedies. One widespread kind is the payday advance, generally designed for tiny quantities to be paid off on the borrower's following payday. These fundings commonly include high-interest rates, making them suitable for emergency situations yet less ideal for lasting economic requirements.

One more common online lending kind is the individual installation car loan. This option gives debtors with a lump sum that is settled in routine installments over a specific duration. The rates of interest for installation fundings are normally lower than those for cash advance, making them a much more budget friendly alternative for bigger expenditures.

In addition, on-line lenders likewise use lines of credit scores, which supply borrowers with a predetermined credit score limit. Each type of online funding offers distinctive purposes, enabling debtors to pick the most suitable option based on their financial demands.

Variables for Picking a Car Loan

When taking into consideration a lending, it is vital to carefully examine your economic demands and situations to establish the most suitable choice for your circumstance. When selecting a lending:, several essential factors should influence your decision.

Rate Of Interest: Compare rates of interest used by various loan providers. Reduced prices can result in significant financial savings over the life of the loan.

Costs and Fees: Know any type of additional charges or charges related to the finance, such as origination costs, early repayment penalties, or late settlement charges.

Repayment Terms: Take into consideration the payment duration and regularity of payments. A longer term might lead to lower month-to-month payments yet higher overall rate of interest costs.

Finance Amount: Make certain the funding amount satisfies your financial demands without overburdening you with extreme debt.

Credit Rating: Your credit report can affect the car loan terms you are offered. Goal to improve your credit score to accessibility better financing choices.

Client Service: Pick a loan provider recognized for outstanding client service to help you throughout the lending procedure.

Leading Online Lending Providers

Taking into consideration the necessary factors for selecting a funding, it is vital to discover trusted on-line lending providers that align with your economic requirements and choices. When seeking a top on-line lending carrier, it is important to consider aspects such as rates of interest, financing terms, costs, client service, and overall credibility. Among the leading online financing carriers is LendingClub, known for its competitive prices and transparent charge structure. An additional credible choice is SoFi, which uses a variety of financing products with versatile terms and advantages for borrowers. Additionally, Marcus by Goldman Sachs is acknowledged for its straightforward online platform and outstanding client service. For those with less-than-perfect debt, BadCreditLoans.com provides access to loan providers going to work with individuals with reduced credit history ratings. Eventually, selecting a leading on-line car loan provider entails complete study, comparing deals, and choosing a lender that finest suits your economic requirements while making certain transparency and reliability in the loaning process.

Application Refine for Online Loans

To efficiently get an on the internet funding, customers have to first thoroughly assess the lender's qualification needs and gather all required documentation. Each loan provider might have details requirements regarding credit report, income degree, work condition, and various other aspects that establish a candidate's qualification. payday loan places in my area. As soon as the debtor has established their qualification for a particular online finance supplier, the application process normally entails filling in an on the internet kind with you can look here personal, economic, and work information

Advantages of Online Funding Provider

Having actually developed the application procedure for on the internet financings, it is imperative to highlight the numerous advantages that on-line lending services offer to customers seeking fast monetary options - payday loans near me. One of the primary benefits of on-line financing solutions is the ease they give. Borrowers can get financings from the convenience of their very own homes or on the move, without the requirement to go to a physical bank or lender. This ease conserves time and initiative, making the borrowing process more reliable.

In addition, online lending solutions usually have quicker authorization times compared to conventional banks. This means that consumers can get the funds they require in a shorter amount of time, which is crucial in emergency situations or when fast accessibility to cash is called for. Additionally, on the internet car loan solutions may supply a lot more competitive rate of interest and flexible settlement terms, giving consumers much more options to select from based upon their financial needs.

Furthermore, on-line financing services typically have streamlined application processes that call for minimal documentation, making it simpler for consumers to apply and get approved promptly. In general, the benefits of on the internet finance solutions make them a preferred choice for cash loans near me individuals seeking fast financial support.

Verdict

The application procedure for on-line finances is easy and structured, allowing consumers to gain access to funds quickly. Generally, online finance services give an important source for individuals looking for financial help in a prompt manner - Easy to find a Fast Online Payday Loan.

An additional common online financing type is the personal installation lending. The rate of interest prices for installment loans are typically reduced than those for payday financings, making them a more economical alternative for larger costs.